News & Insights | 5th August 2020

Wealth Planning

8 Min Read

Over the last few months, many individuals have found themselves more focused on life after full-time work and what it means to them. Changing values in investments have startled those who wouldn’t normally consider themselves ‘investors’ as they have seen the value of their pension pots fluctuate. For those who only check the value of their pension when their annual statement arrives, unfortunate timing gave many an unpleasant surprise in March and April of this year.

Working from home and a lack of opportunities to spend money, may have brought into focus quite how high spending habits in ‘normal life’ were. This has led to consideration as to whether a better balance may be found – am I saving enough for the future? When will be I be able to scale back or stop work? How much do I need to maintain my desired lifestyle?

Step one – understanding what you have

What are you currently paying into? It is likely that you have a pension which was set up by your employer or perhaps a private arrangement if you are self-employed. Have you ever increased your contributions, and do you know what your contributions are investing in? Perhaps you have several older pension plans, are they still fit for purpose or might their value be put to better use elsewhere?

Similarly, you might have accumulated a variety of stocks and shares, or cash ISAs, by making lump sum payments to different providers. If you are a regular saver, have you checked your rates? Savings rates change, and some can drop substantially after a higher introductory period.

Assembling a list of policies and plans, enables you to put together your personal balance sheet, and allows you to see what you might be relying upon once you stop earning.

It is also good practice to have a proper look at your ongoing expenditure. Break down your monthly spending habits into essentials which might include mortgage or rental payments, utilities, council tax and household insurances. Next comes discretionary spending, for things such as groceries and clothes, and gym or club memberships. Finally, luxury spending, such as holidays, dining out, going to events, or simply the more expensive versions of your favourite purchases.

In pre-lockdown times, it would have been very easy to spend on ad-hoc items, such as an impromptu night out, or those quick stops on the way home to pick up one thing from the supermarket that turn into a higher than anticipated spend. While it may seem like a distant memory, it is worth looking back at your pre-lockdown spending patterns, to get a true picture of where your money goes. This is not an exercise to remove the ‘fun spending’ from your budget, but, if you are not getting good value from your current spending, is that money better saved for future spending pleasure? With lockdown sales at Pret A Manger down to 15% of their normal level, many households have realised quite how much their sometimes twice daily, pre lockdown Pret habit, was costing each month.

Make a change: instead of having a coffee on the way to the office each morning, save the cash and put it in a stocks and shares ISA each year. After 30 years, your coffee savings could have turned into a pot worth c.£59k.

Once you understand your current level of expenditure, it is time to imagine what your expenditure might be once you stop work. There may be a reduction in ongoing costs, the mortgage might be paid off, children may have flown the nest and there will no longer be the costs of travelling to work, or a working wardrobe.

But that’s not to say that overall costs will definitely reduce. You might want to the treat the family to the holiday of a lifetime. Or it might be time to tick off a long list of travel destinations, expensive hobbies that there simply wasn’t the time for before, or renovations on a property that you’ll now be spending more time in.

Your expenditure might more easily be considered in two parts, firstly a more active stage, with a list of things you would like to do, and might be more physically able to do, the second stage might be less active and likely less costly.

Do you plan on downsizing, or have you always dreamt of a holiday home, here or abroad? How do you feel about leaving an inheritance? Did you receive a legacy that you wish to pass on or are you hoping to spend as much as you can and leave nothing behind but excellent anecdotes!

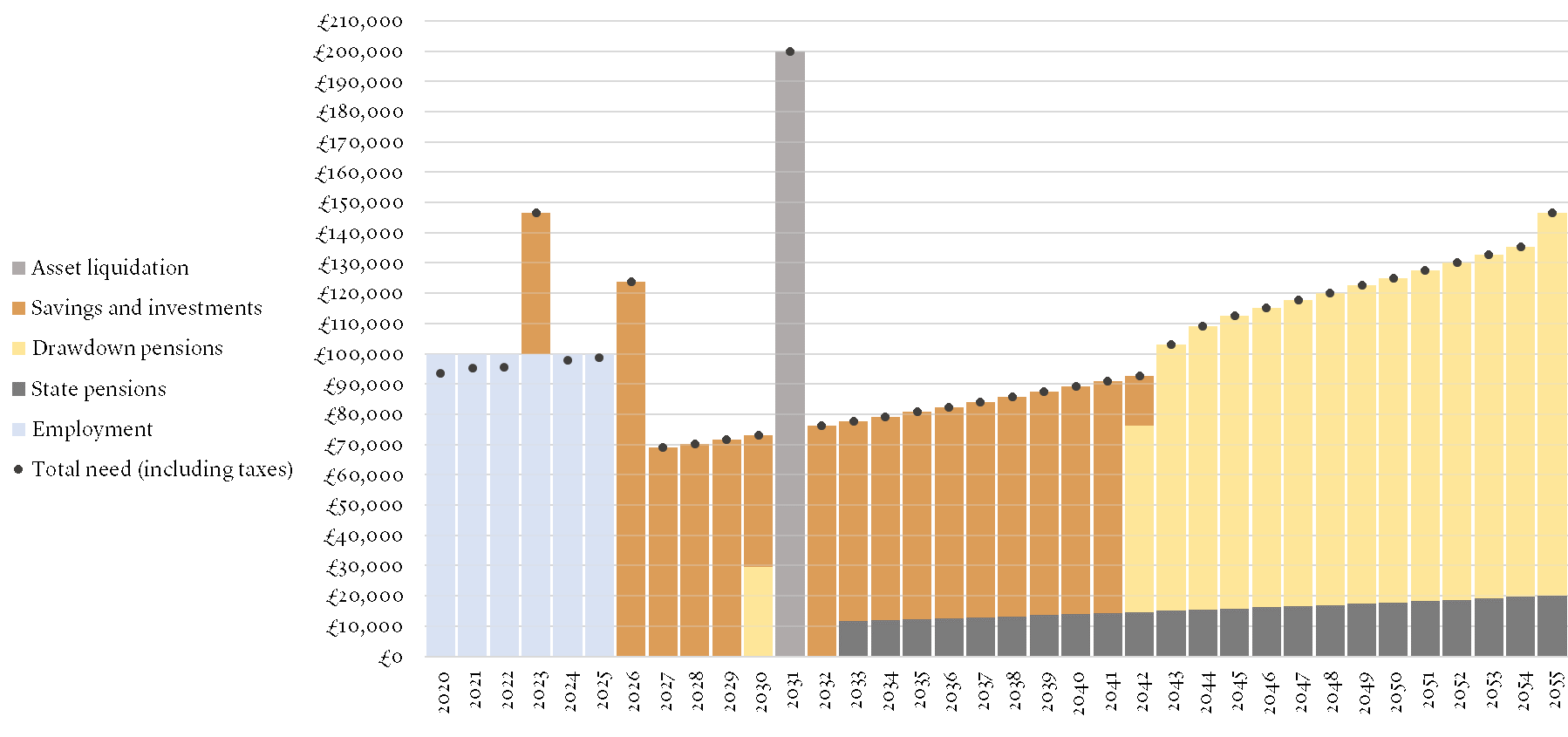

Now you know what you have, and what you would like to have in the future, how do you know if you are heading in the right direction? Cashflow modelling software can take this information and forecast whether today’s spending and saving patterns are likely to get you into the financial position you hope to achieve. The chart below shows how an individual’s personal spending requirements might be met over the next 35 years, using employment income, downsizing, savings, investments and finally, their pension income.

If you are on target, you might consider stopping working a little earlier, or perhaps cutting your hours to participate in the volunteering role you would like to say yes to? Maybe you would like to offer your experience to start-up companies eager to learn from years of industry know-how?

Step four – revisit the plan

Once you’ve looked into the future, perhaps reallocated assets, or changed your spending or savings habits, what next? There are very few occasions when we can look back over five or ten years and say that everything has gone as expected. The same can be said for making financial plans. Even without personal upheaval, or professional changes, new legislative and regulatory requirements make it important to update them regularly.

This enables you take advantage of allowances as they arise, e.g. if you do not utilise your ISA and capital gains tax exemption each year they are lost. Your plan should also be tweaked to match changing circumstances, perhaps the receipt of an inheritance, or a reduction in income due to a career change. Assessing your current situation with one eye on the future, helps you to be more prepared for the unexpected, able to weather the bad surprises and take advantage of good opportunities!

Once you stop work, your planning should not stop. Today, a 65-year-old is expected to live into their mid-80’s, and with one in four living into their 90’s, your investments may need to last 20-30 years.

How much can I withdraw: The Institute and Faculty of Actuaries suggests that 3.5% is the sustainable rate of withdrawal if an individual enters the process of drawing down from their investments at age 65. With a pension pot of £1,073,100 (the current Lifetime Allowance for pensions) this could amount to an after-tax income of just c.£2,500 per month.

A flexible, tax efficient, retirement is unlikely to consist of a single pension. Withdrawals from ISAs, savings and investments, together with the State Pension, can help to build your required annual income. Taking the tax-free part of your pension in stages, rather than a one-off lump sum, can help to lower your income tax bill over multiple tax years. If you wish to maximise your income and aim to reduce your assets as much as possible over time, careful planning will help you avoid running out of money too soon.

So, how much do you need to stop work? Probably more than you think, but planning for the future, making some changes, and having clear goals, will increase the chances of experiencing the type of life you wish for beyond full-time work.