News & Insights | 31st May 2023

Investment Management

4 Min Read

Dan Benzimra, one of our Investment Managers here at Connor Broadley was recently interviewed by Citywire New Model Adviser’s editor Charles Walmsley. In a broad-ranging discussion, Dan offered up a point of view on the role of active and passive funds in client portfolios.

THIS ARTICLE FIRST APPEARED ON THE CITYWIRE, NEW MODEL ADVISER WEBSITE, 30th MAY 2023

London-based Connor Broadley believes both active and passive funds have a role to play in client portfolios.

While some advice firms take a hard-line approach to investing actively or passively, others blend strategies. London-based Connor Broadley, a Citywire New Model Adviser Top 100 firm, is one company that uses both types of management in its portfolios depending on asset class, economic conditions and client preferences.

‘Within equities we would probably call it at 80/20 towards passive. Within bonds, we are actually more active, because we think there’s more strategic reason why an active bond manager can outperform the benchmark. So we probably flip the other way around, 20/80 to active,’ says Dan Benzimra, investment manager at Connor Broadley. He argues that placing a lot of emphasis on asset allocation decisions means picking active equity funds is not the right approach for clients. ‘Because we are more asset allocation based, we probably are a bit more tactical than some of our peers. It feels unfair to say to an active manager: “We’re coming in, but we don’t know how long we’ll be with you”.’

The passive/active strategy seems to be paying off: Connor Broadley’s DIS Classic Medium to High Risk portfolio saw 27% in cumulative returns for the three years to end of April, compared to a comparative industry portfolio, ARC Sterling Steady Growth PCI, which returned 17% over the same period.

Equities

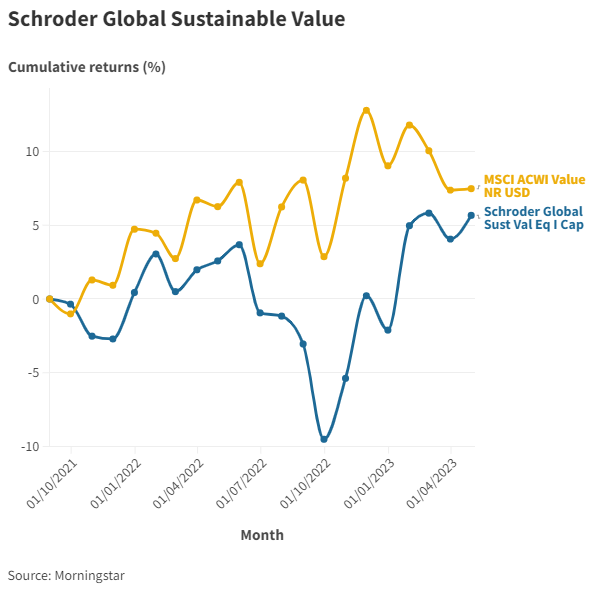

One exception to the passive lean for equities is the Schroder Global Sustainable Value fund. Benzimra says the fund is a useful diversifier in ESG portfolios. It currently accounts for 12.7% of the firm’s medium-risk progressive portfolio, a significant weighting that reflects the difficulties gaining exposure to value stocks in ESG. ‘We were always aware of this style bias, so were constantly rescreening the universe to see what was coming up,’ he explains.

The fund, managed by Citywire A-rated Simon Adler and Liam Nunn alongside Roberta Barr, rebranded as a sustainable strategy in August 2021. At the time of the name change it was just £26.3m but has shot up in size to £695m since then as investors sought ESG value options. A cynical take is that the name change was just a marketing switch to attract these investors, but Benzimra says the fund’s management team did enough to the portfolio to justify the shift. ‘You will continue to see more of that renaming, maybe more through the energy transition lens rather than purely going green,’ he adds. ‘Our portfolios are not designed to be impact or to negatively screened.’

Since the name change the fund has slightly underperformed the MSCI Value index benchmark (see graph above), reflecting the fact the sustainable screen removed strong performing energy stocks such as oil giant Exxon Mobil and petrol refining company Chevron.

Elsewhere in equities Connor Broadley sticks to ETFs in line with its tactical allocations, leaning heavily towards the US, with 23% of the normal portfolios and 18.6% of the progressive options allocating towards S&P 500 or Nasdaq-based trackers.

Bonds

GAM Star Credit Opportunities fund is currently a big holding at 6.4%. The strategy has been a consistent underperformer in recent years, with outflows of £539m over the past 12 months according to Morningstar. It took another hit in March when Credit Suisse AT1 bonds were wiped out as part of its merger with Swiss rival UBS. ‘It is a bit more bank focused, so unsurprisingly it really felt the pinch on the back of the Credit Suisse and UBS merger,’ Benzimra says.

Yet the weighting towards financial bonds, particularly the riskier type of debt known as AT1, has boosted yields in the portfolio. The fund’s factsheet for the GBP share class states at the end of April showed the average coupon rate, that is the amount paid out by fixed income holdings over a year, had crept up to 5%, compared to 3.8% on the Bloomberg Sterling Aggregate Corporate Total Return Index benchmark. ‘It’s been tricky, but the yields are now looking very, very attractive,’ he says. ‘If you think that the banking sector could get through this moment unscathed, at a more macro level, without systemic issues, those are pretty attractive yields.’

In responsible portfolios the BlueBay Global High Yield ESG Bond fund has been swapped in as a 4.6% holding in the fixed income portion. Meanwhile the passive exception in the firm’s bonds portfolios are holdings in Lyxor’s US Treasury Inflation Protected Securities ETFs. These invest in fixed income assets which yield more as inflation goes up.

The rest

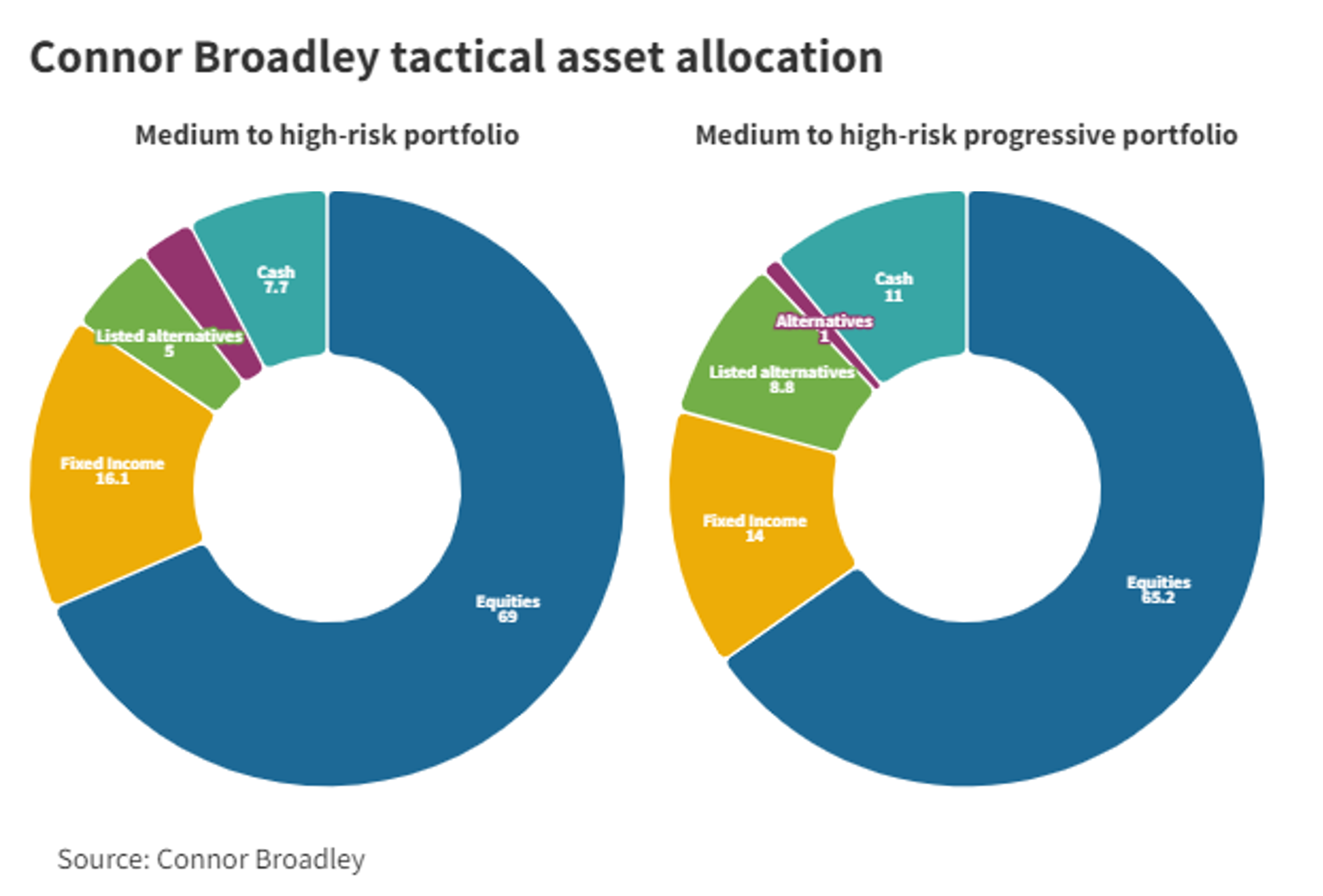

Pure alternatives play a small role in Connor Broadley’s portfolios, although there is an allocation of 5% in the normal portfolios and 8.8% in the progressive option to listed alternatives in the form of trusts.

Cash allocations are currently higher than normal on the back of economic conditions. Much of this is held in money market funds, which have seen high levels of inflows from investors across the world this year as a play for high yields from short-term debt. The firm uses Goldman Sachs’ sterling Money Market fund and Pictet’s offering for Euro exposure. Given the similarity between most funds in the sector, picking a fund generally comes down to finding a manager who can quickly invest client’s money with minimum fuss.

‘It sounds a little horrible to say, but they are much of a muchness, so it becomes about fees and operational complexity basically.’